Chinese restriction on coal imports

China’s government introduced coal import restrictions from mid-November, to keep 2018 foreign purchases in line with 2017 levels of 271m tonnes. The restrictions led to imports in November falling to a 16-month low of 638,000t/day (19.2m tonnes), according to customs data, but more recent figures have yet to emerge. A Chinese coal analyst said it appeared there were no official restrictions on coal imports at present, but that import activity remained subdued.

Shipbroker Intermodal said the period leading to Chinese New Year was a seasonally slow time for dry bulk vessel demand.

“Expectations remain rather modest for the coming weeks, with owners hoping the market will see restricted downward pressure”

it added. Shipbroker Arrow said rates in the Pacific had come under pressure from surplus vessel availability.

“Lagging Australian and Indonesian coal demand has distracted from what is quite steady north Pacific grain market”

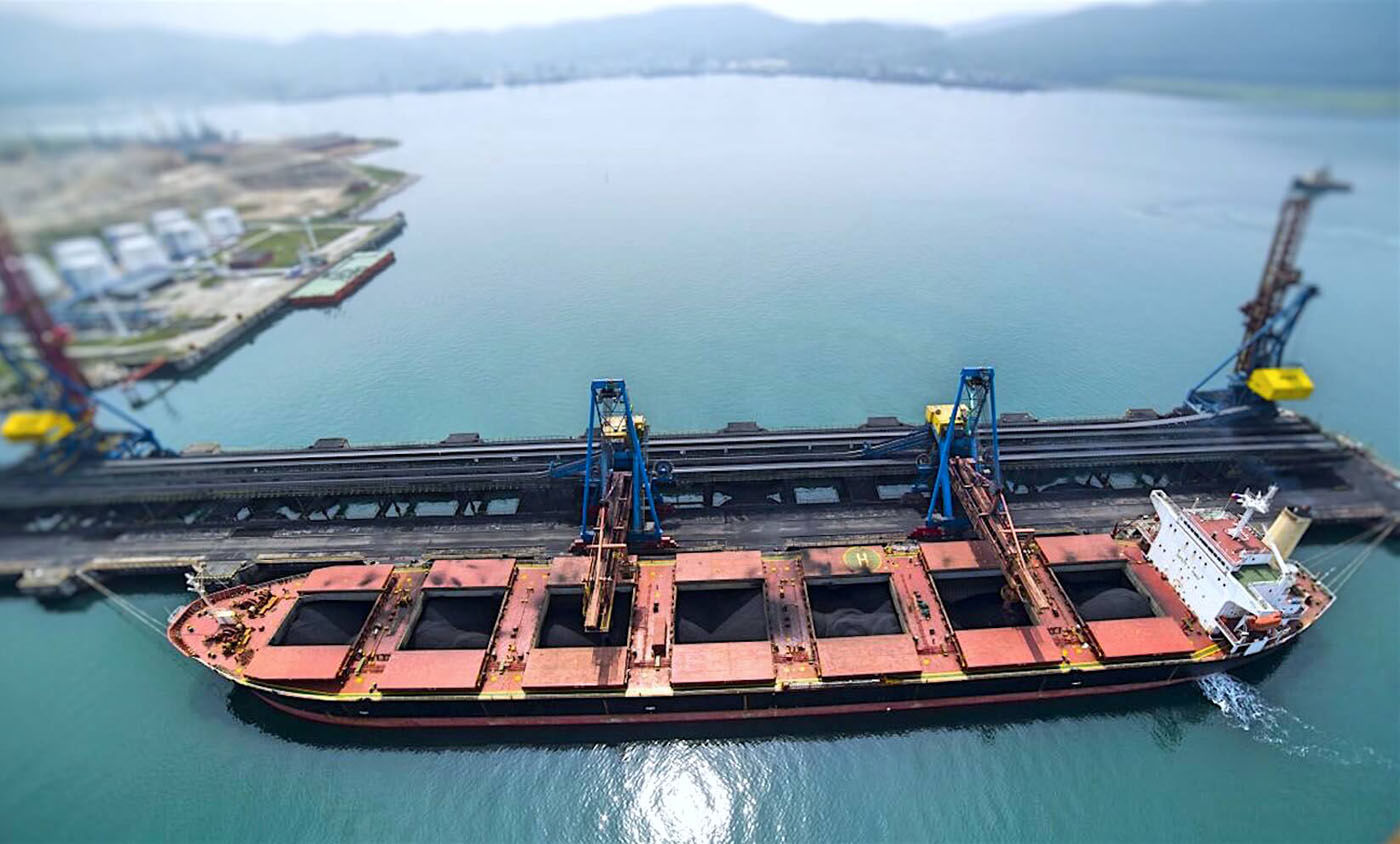

coal import process is related coal shiploading by shiploader at export port and shipunloading by ship unloader at import port, coal is conveying transported by belt conveyor at ports or terminals.

China Restriction Affects Coal Imports

No change occurs in the sourcing pie in 2019, the yearly seaborne trade could decrease by 8.6 million tonnes, rendering more than 10 Panamaxes unemployed.

- Indonesia, Australia, Russia and Mongolia are the most important coal suppliers, which together accounted for more than 95% of imports in 2018.

- Although Mongolian trade is over land, the decrease in trade from key locations could be a serious damage to Panamaxes.

However, there is a possibility of a change in trade patterns due to the continuous political differences between China and Australia, the Dalian custom authority – which handles around 14 million tonnes of annual coal imports – will settle the matter of stopping giving clearance to coal imports from Australia.

China Coal Import Amount Expectation

As a result, in 2019, we expects Australia coal exports to China to be in the region of 71-72 million tonnes, compared with 89 million tonnes in 2018.

In turn we expect any decline in coal imports from Australia to be partly offset by overland imports from Mongolia. If Mongolian exports to return to peak of 36-37 million tonnes, this will leave China with a deficit of 12-13 million tonnes, which it could result in increase in trade with North and South America.

As the voyage distance between China and North America is almost three times that of Australia to China, increased coal imports from latter will more than offset the loss in vessel employment, deploying about 15 additional vessels compared with 2018.